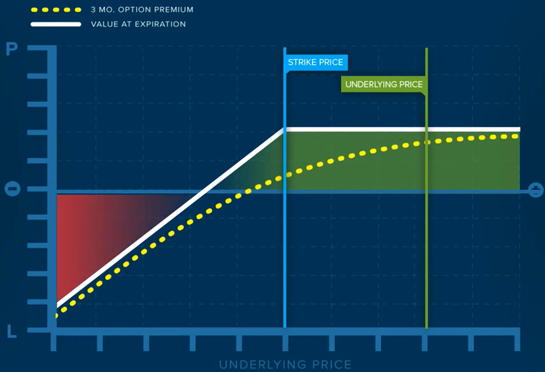

A covered call would be considered by someone who would like to derive additional income from a long stock position. A covered call allows the investor to hold a long equity position while simultaneously receiving the premium from selling an equal amount of call options against it. The covered call writer is bullish on the stock’s long-term potential but is willing to forego a stock’s upside above the strike during the life of the option in order to receive the proceeds of the call premium.

It should be noted that the combined position has a similar profile to that of a short put. The covered call writer remains exposed to any downside in the underlying shares, meaning his loss potential is substantial.